Nigeria’s total foreign debt increased from N46.25 trillion in December 2022 to N49.85 trillion ($108.30 billion) as of March 31, 2023.

Beginning in June 2023, the recently securitized N22.719 trillion in Ways and Means loans will be counted toward the domestic debt of the Federal Government (FG).

A review of Nigeria’s debt situation is necessary in light of the Naira’s peg to the US dollar of N765 to N770 and the rise in public debt.

Nigeria’s total foreign debt for the period ending March 31st, 2023, increased from N46.25 trillion as of December 21st, 2022 to N49.85 trillion ($108.30 billion).

This information was released in a statement by the Debt Management Office, DMO, on Friday night. The DMO also stated that starting in June 2023, the recently securitized N22.719 trillion in Ways and Means loans would be counted as FG Domestic Debt.

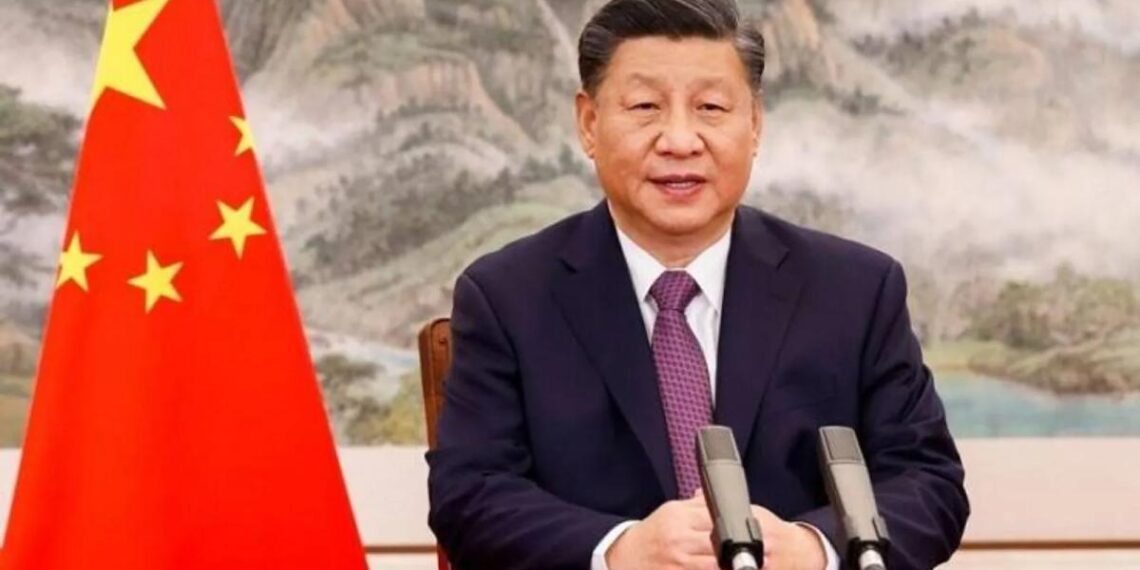

This occurs as a result of the Tinubu administration’s recent monetary policy, which has seen the Naira maintained at a peg of N765 to N770 and called for a review of the public debt.

Greater debt.

The statement stated that as of March 31, 2023, the total public debt, which included the debts of the FG, 36 states, and the federal capital, was N49.85 trillion, or $108.30 billion.

Comparatively, as of December 31st, 2022, the total public debt stock was N46.25 ($103.31 billion).

The debt stock of the FG, States, and the FCT increased over the course of the time period. ”.

The N22.719 trillion in Central Bank of Nigeria Ways and Means Advances are not included in the Public Debt Stock for March 2023, they added.

“Whose securitization received National Assembly approval in 2023. From June 2023, the sum will be a part of the FG’s domestic stock debt. ”

Background information.

Before this most recent update to the debt report, it has been reported in May that the Nigerian National Assembly had approved the securitization of loans totaling N22.7 trillion from the Ways and Means Department.

It is anticipated that the securitized debt will increase debt transparency, lower debt service costs, and aid in reducing the budget deficit over its 40-year term with a 3-year principal repayment moratorium and a 9 percent interest rate.

The Ways and Means section of the budget makes reference to a clause that permits the government to borrow money from the Central Bank of Nigeria (CBN) in an emergency or short-term situation to cover fiscal deficits or delays in expected government cash receipts.

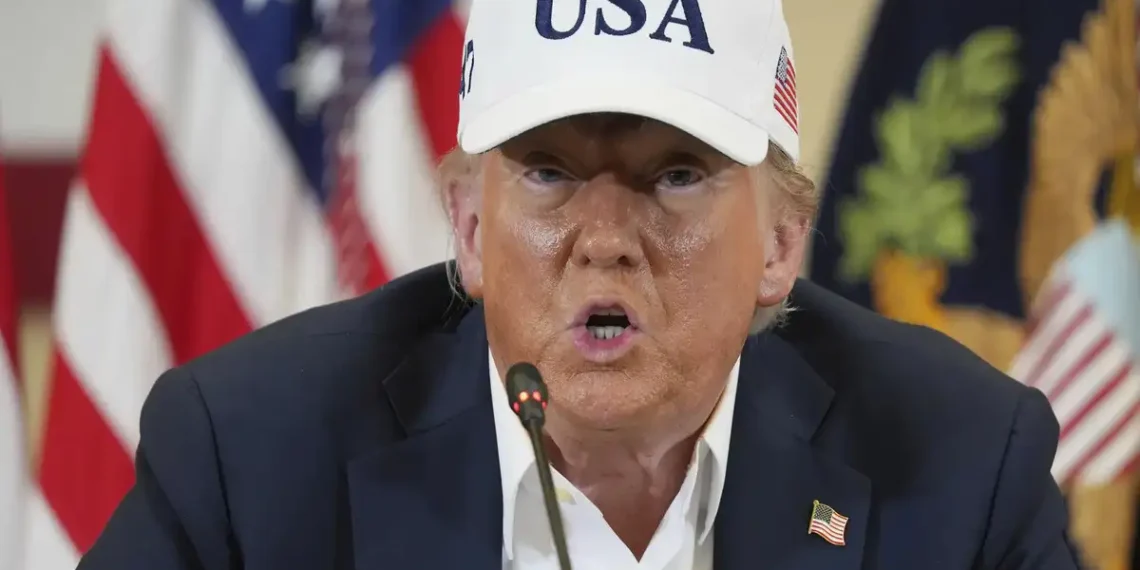

The Buhari administration has exceeded the act’s 5 percent cap on the monetary financing of fiscal deficits. The Buhari administration submitted a bill to the national assembly that would have allowed the loan to be converted into a national debt, legalizing the breach.

The Securitization’s terms.

The tenor of the securitization is a whopping forty (40) years, with a three-year moratorium on the principal and an interest rate of nine percent per year, according to the most recent data from the Debt Management Office.

40 years old is the tenor.

Three (3) years are the moratorium (on the principal only).

Rate of Interest: 9% per annum.

Thirty-seven (37) year amortization is used for repayment.

The Federal Government of Nigeria (FGN) will issue the Securities to the Central Bank of Nigeria (CBN) as the Holder. The FGN will not issue the Securities to the general public in order to raise money.