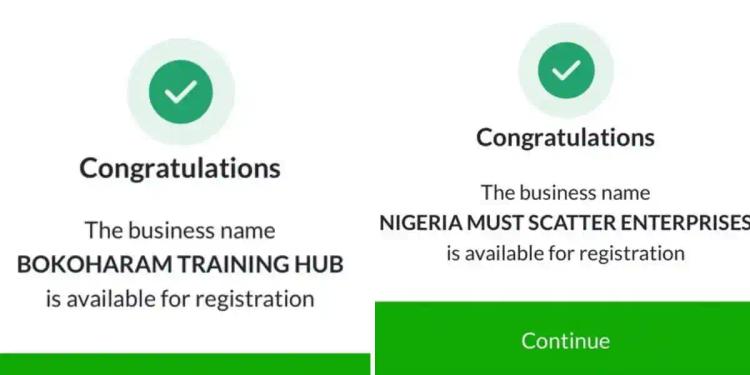

Governor of the Central Bank of Nigeria, CBN, Mr Godwin Emefiele has cautioned Nigerians to stop transacting with popular loan platform, sharks, according to him, patronising them comes with scathing conditions and humongous interest rates that eventually hurts the borrower.

The CBN Governor gave the advice on Tuesday in Abuja, at a media briefing to draw the curtain on the 140th Monetary Policy Committee (MPC) meeting and the first in 2022.

He said: “If we see loan sharks, we shall deal with them. When we find them in an organised setting, we will deal with them. They’re mostly in rural areas and we are not the police to deal with them. Do not patronise loan sharks. Go to NIRSAL MFB. Fill out the forms and input your details. You don’t need to know anyone”.

According to him, 10 members of the MPC were in attendance and unanimously agreed to hold all monetary policy parameters, leaving the Monetary Policy Rate (MPR) at 11.5 per cent; asymmetric corridor of +100/-700 basis points around the MPR; the CRR at 27.5 per cent; and Liquidity Ratio at 30 per cent.

The MPC, Emefiele noted, expressed concerns over the insecurity challenges plaguing the country and called for lasting solutions to the nightmare since it was capable of retarding the economic recovery momentum and concerted efforts at tackling rising food prices.

Emefiele however vowed to crush loan sharks whenever and wherever he finds them since they charge a hundred percent interest on any loan.

Emefiele advised loan seekers to approach the banks or visit websites of NIRSAL microfinance bank to access available facilities without recourse to anyone or group to facilitate the process.

The Committee also called for stronger economic diversification efforts as dependence strongly on crude oil receipts comes with unsavoury consequences.

The MPC also advised the federal government to seek more efficient infrastructure financing, even as it hailed the downward trajectory of Non Performing Loans (NPLs). On advanced economies’ signal of normalisation and withdrawal of interventions to the third world by raising interest rates which ultimately leads to capital flow reversals, Emefiele said there was no course for Nigeria to lose sleep.

“Fortunately, when those loans were offered, they did not come into Nigeria. In the last two years, it’s been a gradual and systematic exit of foreign portfolios out of the country because they feel the yields are not as high and they look for more hedging efforts to help them.

“MPC adopted a policy that lowers interest rates and attracts borrowers who have projects to finance them. That is why in the last two years, we’ve boosted loans given to households and businesses to moderate inflation, boost manufacturing and all that

![Isin Kara: Business activity commences as Olusin Inspects Market [Video]](https://ideemlawful.com/wp-content/uploads/2025/08/IMG-20250812-WA0016-75x75.jpg)

![[Insider] Power Play at OAU: New PRO-CHANCELLOR Bullying Tactics](https://ideemlawful.com/wp-content/uploads/2024/11/OAU-Front-View.webp)

![Isin Kara: Business activity commences as Olusin Inspects Market [Video]](https://ideemlawful.com/wp-content/uploads/2025/08/IMG-20250812-WA0016-360x180.jpg)