The Central Bank of Nigeria (CBN) has countered claims that its new policy limiting cash withdrawals is targeted at point-of-sales (PoS) agents in particular.

Though the apex bank, on December 6, set the daily withdrawal limit at N100,000 and N500,000 for persons and organisations, respectively, it made allowances for compelling cases to withdraw up to N5 million or N10 million.

“Let me just correct an impression: not in any way are they (PoS agents) endangered,” the CBN’s Director of Banking Supervision, Mustafa Haruna, said during a live appearance on Channels Television’s Sunrise on Saturday.

“When you do the numbers, how much does a typical agent outlet need in a day? People need to just see this as a policy that is intended at contributing to economic growth and development, and when Nigerians know the enormous benefits inherent in this policy, I’m very sure it will shift mindsets.

“It is typical when you introduce something new, there is always that trepidation and apprehension. But that is why we are also combining it with extensive and sustained campaigns and sensitisation just to ensure that Nigerians understand what is at play, what is involved, and what is in it for them.”

Haruna cited the December 6 circular of the apex bank which stated that in “compelling circumstances,” should an individual or organisation need an amount above the set limit, there are conditions to fulfill.

The CBN had stated that in such instances, not exceeding once a month, withdrawals above the limit shall be subject to processing fees of five and 10 percent for individuals and corporate entities, respectively, in addition to “enhanced due diligence and further information requirements.”

Applicants are also required to upload the following on the CBN’s portal: Valid means of identification of the payee (National ID, International Passport, Driver’s License); Bank Verification Number (BVN) of the payee; and notarised customer declaration of the purpose for the cash withdrawal; senior management approval for the withdrawal by the Managing Director of the drawee, where applicable; and approval in writing by the MD/CEO of the bank authorising the withdrawal.

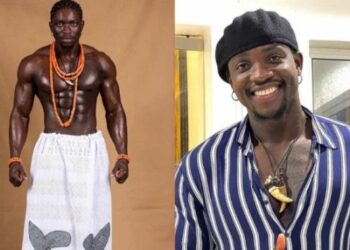

CBN Director of Banking Supervision, Mustafa Haruna, appeared on Channels Television’s Sunrise on Saturday December 17, 2022.

Haruna explained that the CBN had seen exponential growth in the agent networks around Nigeria, describing them as “quite ubiquitous.”

“There is hardly any nuke or cranny in Nigeria where you go that you won’t see one agent outlet or the other where they do cash-in, cash-out services. Such customers can take advantage of those services,” the CBN director said.

“But to the point about the quantum of naira such a customer would need, of course, this is an evolutionary process; we will get there. And if you have such a need for a high volume of cash, you can always go to your bank to say, ‘Look, this is my business,’ and they will be able to (attend to you).”

According to him, the CBN policy was about expanding the cashless policy first launched a decade ago as a pilot programme in major cities like Lagos and Abuja. He explained that scaling up the policy was necessary due to the high cost of currency management.

“We started since 2012 and we had some charges that you have to pay, although the revised limit and charges are different from what we had. This is not something new. We feel we should take things to a high level if we must make progress, in line with global trends,” he said